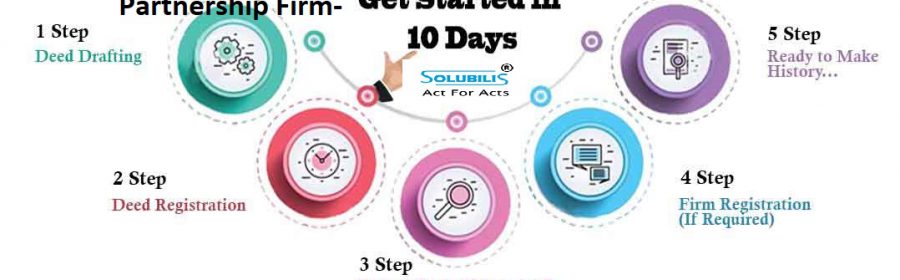

Registration of Partnership firm in Chennai- Step by Step Procedure

Partnership firm is one of the most important forms of business organization, where two or more people do business together and share its profits in an agreed manner. Partnerships are easy to form, and compliance is low compared to companies. Any name can be given to a partnership pay firm until you meet the following conditions:

- The name should not be too similar or identical to an existing pay firm doing the same business,

- The name should not contain the words emperor, crown, empress, empire or any other word that indicates the approval or sanction of the government.

Partnership Agreement/ Partnership deed in chennai

A partnership deed in chennai is an agreement between partners that sets out each partner’s rights, duties, profit share and other obligations. Also a partnership deed can be written or verbal, although it is always advisable to write a partnership deed to avoid future conflicts.

Details present in the partnership deed

a. General details:

1. Pay firm and name and address of all partners

2. The nature of the business

3. Date of commencement of business capital to be contributed by each partner

4. Contribution capital by each partner

5. Profit / loss sharing ratio among partners

B. Details:

Apart from this, specific clauses may also be mentioned to avoid any contradiction at a later stage:

1. Interest on invested capital, drawing by partners or any loan given by partners for pay firm

2. Salary, commission or any other amount payable to partners

3. The rights of each partner, including the additional rights enjoyed by the active partners

4. Duties and duties of all partners

5. Adjustments or procedures to follow in the wake of retirement or the death of a partner or the dissolution of a firm.

6. Other clauses as partners may be decided by mutual discussion

. Apart from partnership firm registration, we also involve in private limited company registration in chennai. If the firm’s partners wish to terminate the partnership, they may do so by dissolving the partnership by notice, if it is a partnership of will. The partnership can be dissolved according to the terms set out in the partnership deed, or it can do so by entering into a separate agreement.

Features of partnership firm in chennai

1. Two or more persons:

At least two people must complete the resources to start a partnership. The Partnership Act, 1932has no mention of any maximum limit on the number of partners. However, the Companies Act, 1956 states that in the case of banking business, the participation or affiliation of more than 10 persons and 20 persons in other types of business which is illegal until and unless registered as a joint stock company.

2. Agreement:

Partnership firm registration in chennai exists through an agreement between individuals who are eligible to enter into an agreement (e.g. minor, insane, bankrupt, etc.) not eligible. Agreements can be verbal, written or implied. However, put everything in black and white and clear the fog around all knot points.

3. Registration:

Under the Act, registration of a pay firm is not mandatory. (In most states of India, registration is voluntary). However, if the pay firm is not registered, some legal benefits cannot be obtained. Implications without registration are- (i) no action can be taken against the other parties in the court of law to settle the pay claims and (ii) in case of dispute between the partners, the settlement of disputes is not possible by the court of law.

4. Profit sharing:

The partnership agreement must specify a way to distribute profits and losses among the partners. A service-oriented hospital, an educational institution run jointly by people from the same organization, will not be seen as a partnership, as it does not share profits or losses. However, sharing profits alone is not the ultimate proof of partnership. In this sense, employees who share profits cannot be called partners unless there is an agreement between the partners.

5. No separate legal entity:

The firm has no personality of its own. The trade ends in death, bankruptcy of any of the partners.

6. Interest Transfer:

The partner will not be able to transfer his interest in the money to outsiders without the consent of the partners. The partner is the agent of the payee and his interest is unwilling to transfer to one-sided outsiders.

7. Mutual trust and confidence:

Partnerships are built around the principles of mutual trust, confidence and understanding between partners. Every spouse is supposed to work for the benefit of all. If trust is broken and partners work on cross motives, the firm will be crushed under its own weight.

Types of partnership firm in chennai

We are broadly classifying partnership organizations in India based on the provisions of the Indian Partnership Act, 1932 and its accompanying rules and regulations, not the registration and registration of a firm. The two types of partnership firm registration in coimbatore pay are illustrated here:

Unregistered Partnership Payment:

An unregistered partnership firm is established by agreement of the proposed pay partners. Legal Registration Partnership without registration allows the partners to continue the business as stated and provided in the contract.

Registered Partnership Payment:

The partnership is registered with the jurisdictional firm (RF) at the place of business. The registration of a partnership pay firm involves the payment of a government fee to the registrar, which varies from state to state according to state law.

What is the advantage of Partnership firm registration in chennai?

Easy to get started

Partnerships are one of the easiest ways to get started. In most cases the only requirement to start a partnership firm registration in t nagar chennai is a partnership deed. Therefore, the partnership can be started on the same day. On the other hand, LLP registration will take about 5 to 10 working days, as digital signatures, DINs, name approvals and attachments must be obtained from the MCA.

To make a decision

Decision making is the need of any organization. Decision making in a partnership pay firm can be quick because there is no concept of passing resolutions. The partners of the partnership firm registration in bangalore enjoy a large number of powers and in most cases the partnership can conduct any transaction on behalf of the firm without the consent of the other partners.