How private limited company raise funds?

The company’s financial system is the engine. It is the most important element affecting the survival and expansion of the company. A public company can easily raise money by offering unlimited shares to the public. However, this is more difficult for a private company as public invitations are not allowed and the maximum number of members is 200. We will focus on many limited liability methods a company can use to raise capital in this blog.

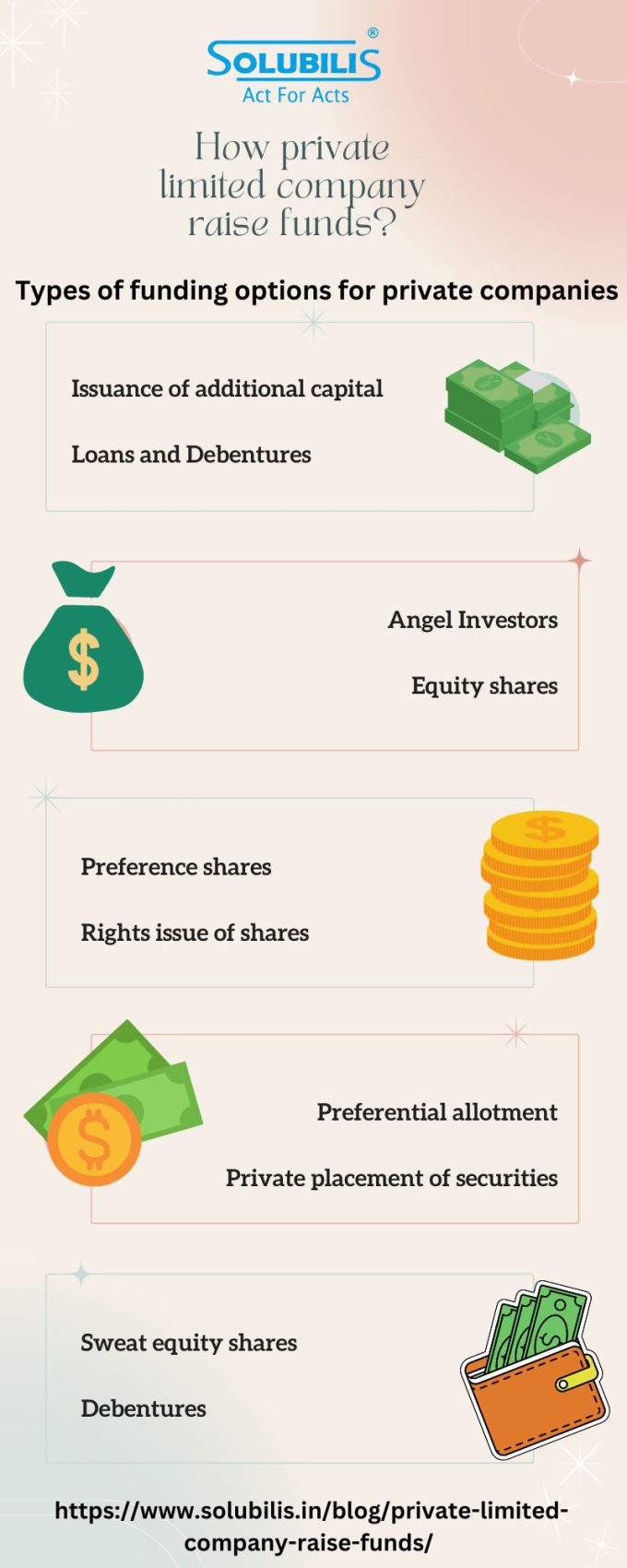

Types of funding options available to private companies

Issuance of additional capital

The Companies Act 2013 provides that a company may increase its subscribed share capital at any time by issuing additional shares which may be sold as follows:

- Private placement

- Rights issue

- ESOP

Loans and Debentures

First, directors and their families can provide the company with an interest-free or interest-free unsecured loan. Bank borrowing is also common. On the other hand, these funds are accumulated over a long, predetermined period of time at a fixed interest rate.

The board must take a decision before borrowing funds from a bank. According to Section 71 of the Companies Act 2013, a limited liability company may also issue Debentures. It is possible with an option to convert all/part of them into shares on redemption.

It is understood that the issuance of convertible debentures requires the approval of a specific resolution passed by the Company’s stockholders at a duly convened meeting.

Through loans and debenture, pvt ltd company with Private limited company registration in Chennai can raise fund.

Angel Investors

Wealthy people who lend money to start-ups in exchange for company shares are known as Angel investors.

Because most Angel investors are private equity professionals, a company seeking financing must have up-to-date financial records, a successful business plan, and a viable exit strategy.

Angel investors often only work with companies that have a high probability of exponential growth and want to go public in the near future.

Through this pvt ltd company which can have Private limited company registration in Chennai, can get fund.

Equity shares

Upon Private limited company registration in Chennai and at any other time the company issues stock through a private placement, rights issue or preference shares grant, the company’s founders have chance to invest in the stock of the company.

Because they spend their hard-earned money on the company with little or no return, the shareholders are both members of the company and its beneficial owners.

A private company with Private limited company registration in Chennai may also issue stock to companies other than the promoters in a private placement or preferential allotment.

Preference shares

Section 43 of the Companies Act 2013 defines “preferred shares” as that portion of the issued share capital of a company which confers or may have a preferential right to: ,

- A fixed or fixed rate dividend payment and

- A repayment of the share capital, if any, on the winding up of the company.

Preference shares may be issued at a predetermined dividend rate. Dividends paid on preference shares may be cumulative (interest is accrued and paid on a specified date) or non-cumulative (interest is not accrued and paid annually).

Preference shares may be convertible; they can be converted into shares at a certain point in time or are non-redeemable.

Preference shares, unlike treasury stock, is a good tool for organizing corporate financing without selling the company’s equity rights.

Thus a company with Private limited company registration in Chennai, can get fund as said above.

Rights issue of shares

In the case of a rights issue of shares, the shares will be offered by the company to persons who are current shareholders of the company at the time of the offer and the shares offered will be in proportion to their current interest in the company.

As per Section 62 (1) of the Companies Act 2013, any letter of offer for rights issue should entitle the rights to dispose of the shares being offered to them for the benefit of another person, which other person is not necessarily the existing shareholders of the company must act.

By issuing shares with rights issue of shares, the company with Private limited company registration in Chennai can easily obtain financing for any purpose.

Preferential allotment

The preferential allotment of the shares is based on the provisions as per Section 62(1) and rule 13 of the Companies (Share Capital and Debentures) Regulations 2014. “Preferential offer” means the issue of shares or other securities by a company with Private limited company registration in Chennai to a selected person or group of persons on preferential terms.

The preference issue does not include shares issued through private placement, call option issuance, bonus issuance, employee options, etc. Shares, fully convertible Debentures, partially convertible Debentures and all other securities that can be converted into shares can subsequently be issued preferentially.

The preferential allotment can be paid in cash or in kind. A company can issue shares on preferential allotment to its promoters, other companies, venture capitalists, angel investors, etc. for fund raising as required.

Private placement of securities

As per Section 42 of the Companies Act 2013, “private placement” means any offer of securities, invitation to subscribe for securities or issue of securities to a select group of persons nominated by letter of the Board of the company private placement being effected and which in meets the requirements set out in this section (it is not a public offering).

In order to effect a private placement of securities, the Company which may have Private limited company registration in Chennai must address a private placement offering letter to a select group of persons designated by the Company’s management.

These individuals must then submit an application form to the Company and pay the required application fee by invoice, check, or other non-cash means.

In this case, the company must submit the relevant documentation and hold the application funds in a segregated bank account that cannot be used until the shares have been allocated and the award has been awarded.

Sweat equity shares

Private companies that has Private limited company registration in Chennai with limited funds or start-ups may issue sweat equity shares to their directors or employees under Section 54 of the Companies Act 2013 for consideration other than cash and not for the services or know-how provided by those employees or directors provide society.

Issuing sweat equity shares is beneficial for both the company and employees as the company does not have many funds to utilize value-added services or expertise and employees would be willing to work sparingly over the companies on which they hold shares.

Debentures

Debentures are securities such as Debenture stock or other instruments of a company that illustrate the indebtedness of a company, regardless of whether they represent a charge on its assets within the meaning of Section 2 (1) 30 of the Companies Act 2013.

An enterprise might give Debentures with a choice to change over them into shares on full or partial redemption.

The company with Private limited company registration in Chennai can issue both secured and unsecured Debentures, but none of them can carry voting rights. Secured debt instruments may be issued if the following conditions are met:

- Debentures redemption dates must be within ten years of the original issuance date.

- The entity must establish a charge that’s sufficient to cover the number of liabilities owed and the interest arising thereon.

- A debenture trustee must be appointed prior to the publication of the prospectus or the invitation to subscribe for the Debentures, but no later than 60 days after the assignment of the Debentures.

- Creates a deed of trust for bondholders to protect debenture holder’s interests.

- In order to repay the Debentures, the company must create a debenture redemption reserve.

Debentures are a great way to raise money through debt, but when it comes to convertible Debentures, the private company with Private limited company registration in Chennai should ensure they never have more than 200 holders.

Conclusion

When a company first starts out, as well as to meet its ongoing financial needs.

At various phases of their turn of events, organizations need various sorts of supporting, going from working capital funding through value capital, span funding, and term advances.

The development of a business is just conceivable with adequate funding plans. A private limited company with Private limited company registration in Chennai can raise the vital capital through stores, credits, and value.

It might get subsidizing through its investor, directors, or relatives, banks or other monetary establishments, individuals, or by giving various monetary instruments.

However, a firm should make sure that it conforms to the Companies Act of 2013, as well as any rules or statutory adjustments made thereto, before utilising any financial facility.