Latest Aspects Of GST Registration & GST Filing In T.Nagar- Chennai

Our Government is taking all the proactive decisions to simplify the much comprehensive GST law that has been made applicable with effective from 1st July 2017. According to the aspects of gst registration and gst filing, this is the biggest tax reform in India has ever seen since independence. As per the report by World Bank, the Indian GST system is amongst the most complex in the world. A careful understanding and applicability of the GST registration provisions will go a great length in guiding all stake holders to create compliant tax structure.

When would one be liable to pay taxes under GST?

According to the aspects of gst registration and gst filing, a person would be liable to pay taxes, if he or she is registered or liable to be registered under GST. And also they are liable for GST registration if they are making a taxable supply of goods or services or both and their aggregate turnover is under the same PAN in the entire country exceeds the threshold limit as provided in GST. Once a person is registered under GST, then any activity carried out by them (sales, service, manufacturing, etc) would fall under the definition of supply unless specifically excluded under the law. There would only be one activity which would be relevant for the purpose of levy of tax (supply). There are three types of levies in GST, CGST Registration- Central Goods & Service Tax SGST Registration- State Goods & Service Tax UGST Registration- Union Territory Goods & Service Tax IGST Registration- Integrated Goods & Service Tax.

Generally, the tax rate in GST is not higher than the previous tax rate. Example, let’s consider the case of goods being purchased under GST era and Pre GST era. Under the earlier law, a consumer used to purchase goods from traders thus they do not normally used to know about the actual incidence of Excise duty and CST (Central Sales Tax) on the goods purchased. But now under GST, the thumb rule which has been generally followed for determination of tax rates is that, the tax rates in GST on goods should be nearest possible to the sum total of VAT+ CST+ Excise Duty. Thus, what we are now observing is sum total of all three taxes on bill and previously while purchasing the goods from a trader, we used to see only VAT on the bill as Excise duty and CST used to be levied at the manufacturing stage. We might theoretically see increased tax rate in GST filing but actually it is not so.

Threshold Limit of GST Registration

As we know, some aspects of gst registration and filing in the GST Regime, businesses whose turnover exceeds Rs.20 lakhs is required to register as a normal taxable person. But in the 32nd, Goods and Services Tax Registration (GST) council meeting was held on 10th January 2019, the Council announced several changes including the new limit for GST registration and it would be Rs. 40 lakh. This decision has been taken by the Council in order to help the small taxpayers to be exempted from the Tax net and so from the compliances and costs.

On considering the demands raised by MSME, the GST council has increased the threshold limits for GST registration which helps to ease the compliances under GST registration. The states have an option to opt for a higher limit or continue with the existing limits.

The new amendments have come with far too many complications and its difficult for a small taxpayer to take a self-decision as to whether he falls within the exemption limit or he is still in the GST regime. Here, we showcased all the important points about the new GST filing threshold limit. The new specified limit is applicable from FY19-20 onward, i.e., for the financial year starting from 1st April 2019.The New specified limit is applicable to only the sale of goods and not services. In the case of the service providers, the limit continues to be Rs 20 lakh except for special states where it is Rs 10 lakh.The new limit is not applicable to the Businessmen who are selling goods out of their state. AS GST registration in chennai is dual taxation (Central and state) law, the rules regarding the limits of turnover are required to be changed in both the Acts. It is supposed to be done for each state in the Central Goods and Services Act, 2017.

ITC- A Core Provision of GST

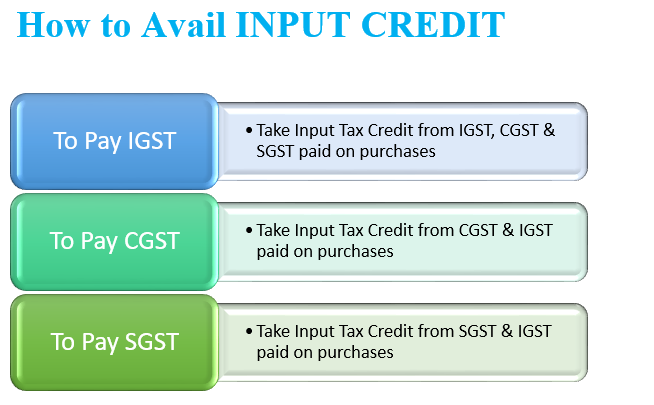

ITC- Input Tax Credit is a core concept of GST registration as GST is a destination based tax. ITC avoids cascading effect of taxes and ensures that tax is collected in the state in which goods or services or both are consumed. It cannot be taken after one year from date of invoice or filing of annual return. Any goods and any input services used or intended to be used by supplier in the course of furtherance of business is eligible for Input Tax Credit. Input Tax Credit is available only if the supplier of goods and services has deposited the tax with Government and only if invoice completed in all respects. It is in nature of benefit extended to dealer under the statutory scheme and it is eligible only when it is credited to electronic credit ledger of taxable person.

“ECT”-Electronic Credit Ledger is the input tax credit ledger in electronic form maintained at the common portal for each registered taxable person. This credit can be utilized for GST liability as specified in section 49(4) of CGST Act.

“Input” means any goods other than capital goods, used or intended to be used by a supplier in the course or furtherance of business – section 2(59) of CGST Act.

“ Outward Supply” in relation to a person, supply of goods or services, by sale, transfer, barter, exchange, rental, lease, license or disposal in course of furtherance of section 2(83) of CGST Act.

Conclusion:

Aspects of gst registration and gst filing in chennai are namely, Threshold limit to take registration has been increased to Rs. 40 lakhs.

Threshold Limit for composition scheme has been increased to Rs. 1.5 crores.

New Scheme is now available @ 6% to Intra-State Suppliers of Goods or Service.

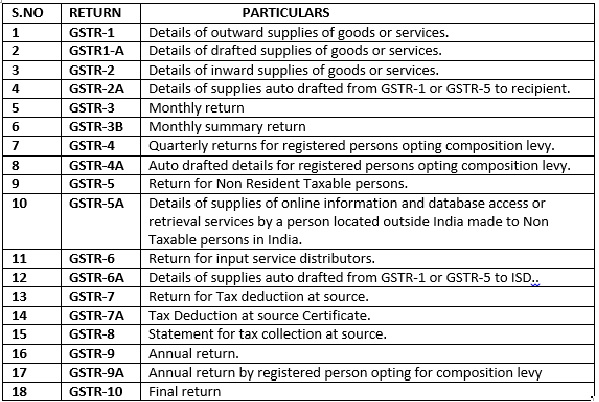

Due dates for filing of GSTR-1 and GSTR-3B have been announced.

Option to opt for Composition Scheme.

Last chance to avail Input Tax Credit relating to F.Y. 2017-18.

To know more about updated GST, click here.