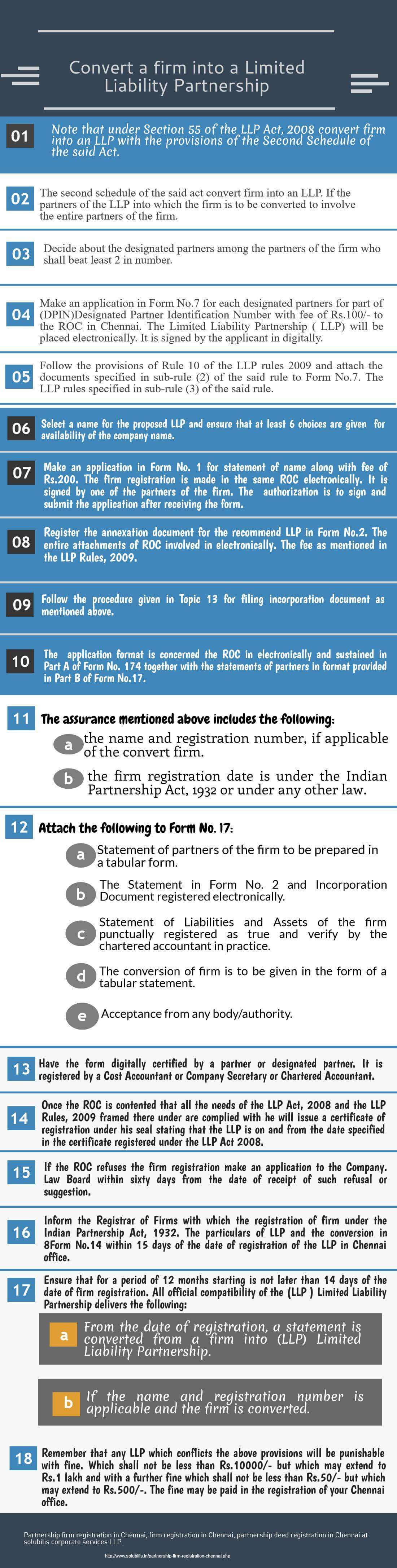

Do you wish to convert a firm into a Limited Liability Partnership

(1) Note that under Section 55 of the LLP Act, 2008 convert firm into an LLP with the provisions of the Second Schedule of the said Act.

Convert firm into a Limited Liability Partnership

(2) The second schedule of the said act convert firm into an LLP. If the partners of the LLP into which the firm is to be converted to involve the entire partners of the firm.

(3) Decide about the designated partners among the partners of the firm who shall beat least 2 in number.

(4) Make an application in Form No.7 for each designated partners for part of (DPIN)Designated Partner Identification Number with fee of Rs.100/- to the ROC in Chennai. The Limited Liability Partnership ( LLP) will be placed electronically. It is signed by the applicant in digitally.

(5) Follow the provisions of Rule 10 of the LLP rules 2009 and attach the documents specified in sub-rule (2) of the said rule to Form No.7. The LLP rules specified in sub-rule (3) of the said rule.

(6) Select a name for the proposed LLP and ensure that at least 6 choices are given for availability of the new company name.

(7) Make an application in Form No. 1 for statement of name along with fee of Rs.200. The firm registration is made in the same ROC electronically. It is signed by one of the partners of the firm. The authorization is to sign and submit the application after receiving the form.

(8) Register the annexation document for the recommend LLP in Form No.2. The entire attachments of ROC involved in electronically. The fee as mentioned in the LLP Rules, 2009.

(9) Follow the procedure given in Topic 13 for filing incorporation document as mentioned above.

(10) The application format is concerned the ROC in electronically and sustained in Part A of Form No. 174 together with the statements of partners in format provided in Part B of Form No.17.

(11) The assurance mentioned above includes the following:

- the name and registration number, if applicable of the convert firm.

- the firm registration date is under the Indian Partnership Act, 1932 or under any other law.

(12) Attach the following to Form No. 17:

- Statement of partners of the firm to be prepared in a tabular form.

- The Statement in Form No. 2 and Incorporation Document registered electronically.

- Statement of Liabilities and Assets of the firm punctually registered as true and verify by the chartered accountant in practice.

- The conversion of firm is to be given in the form of a tabular statement.

- Acceptance from any body/authority.

(13) Have the form digitally certified by a partner or designated partner. It is registered by a Cost Accountant or Company Secretary or Chartered Accountant.

(14) Once the ROC is contented that all the needs of the LLP Act, 2008 and the LLP Rules, 2009 framed there under are complied with he will issue a certificate of registration under his seal stating that the LLP is on and from the date specified in the certificate registered under the LLP Act 2008.

(15) If the ROC refuses the firm registration make an application to the Company. Law Board within sixty days from the date of receipt of such refusal or suggestion.

(16) Inform the Registrar of Firms with which the registration of firm under the Indian Partnership Act, 1932. The particulars of LLP and the conversion in 8Form No.14 within 15 days of the date of registration of the LLP in Chennai office.

(17) Ensure that for a period of 12 months starting is not later than 14 days of the date of firm registration. All official compatibility of the (LLP ) Limited Liability Partnership delivers the following:

- From the date of registration, a statement is converted from a firm into (LLP) Limited Liability Partnership.

- If the name and registration number is applicable and the firm is converted.

(18) Remember that any LLP which conflicts the above provisions will be punishable with fine. The firm or company registration is may convert into your LLP. Which shall not be less than Rs.10000/- but which may extend to Rs.1 lakh and with a further fine which shall not be less than Rs.50/- but which may extend to Rs.500/-. The fine may be paid in the registration of your Chennai office.