Company registration modify existing charges

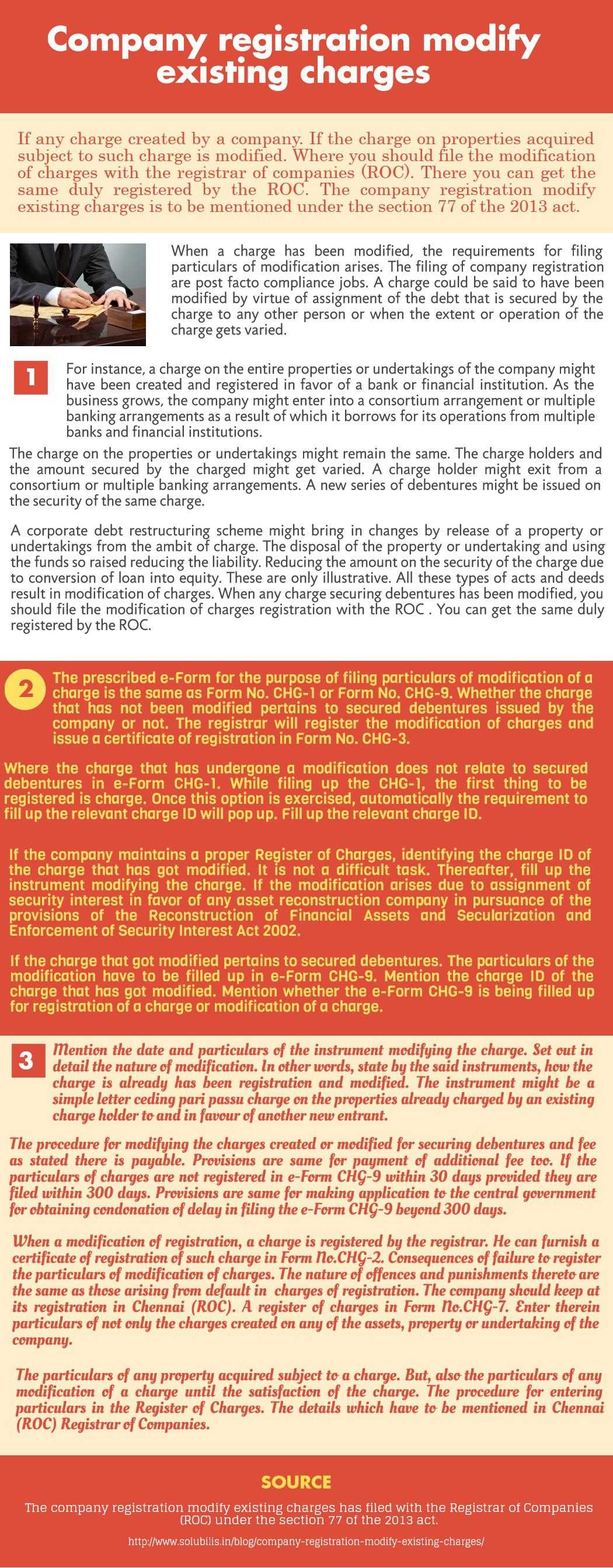

If any charge created by a company. If the charge on properties acquired subject to such charge is modified. Where you should file the modification of charges with the registrar of companies (ROC). There you can get the same duly registered by the ROC. The company registration modify existing charges is to be mentioned under the section 77 of the 2013 act.

Company registration modify existing charges

When a charge has been modified, the requirements for filing particulars of modification arises. The filing of company registration are post facto compliance jobs. A charge could be said to have been modified by virtue of assignment of the debt that is secured by the charge to any other person or when the extent or operation of the charge gets varied.

For instance, a charge on the entire properties or undertakings of the company might have been created and registered in favor of a bank or financial institution. As the business grows, the company might enter into a consortium arrangement or multiple banking arrangements as a result of which it borrows for its operations from multiple banks and financial institutions.

The charge on the properties or undertakings might remain the same. The charge holders and the amount secured by the charged might get varied. A charge holder might exit from a consortium or multiple banking arrangements. A new series of debentures might be issued on the security of the same charge.

A corporate debt restructuring scheme might bring in changes by release of a property or undertakings from the ambit of charge. The disposal of the property or undertaking and using the funds so raised reducing the liability.

Reducing the amount on the security of the charge due to conversion of loan into equity. These are only illustrative. All these types of acts and deeds result in modification of charges.

When any charge securing debentures has been modified, you should file the modification of charges registration with the ROC . You can get the same duly registered by the ROC.

Company Registration Certificate

The prescribed e-Form for the purpose of filing particulars of modification of a charge is the same as Form No. CHG-1 or Form No. CHG-9. Whether the charge that has not been modified pertains to secured debentures issued by the company or not. The registrar will register the modification of charges and issue a certificate of registration in Form No. CHG-3.

Where the charge that has undergone a modification does not relate to secured debentures in e-Form CHG-1. While filing up the CHG-1, the first thing to be registered is charge. Once this option is exercised, automatically the requirement to fill up the relevant charge ID will pop up. Fill up the relevant charge ID.

If the company maintains a proper Register of Charges, identifying the charge ID of the charge that has got modified. It is not a difficult task. Thereafter, fill up the instrument modifying the charge.

If the modification arises due to assignment of security interest in favor of any asset reconstruction company in pursuance of the provisions of the Reconstruction of Financial Assets and Secularization and Enforcement of Security Interest Act 2002.

If the charge that got modified pertains to secured debentures. The particulars of the modification have to be filled up in e-Form CHG-9. Mention the charge ID of the charge that has got modified. Mention whether the e-Form CHG-9 is being filled up for registration of a charge or modification of a charge.

Company Registration Charge

Mention the date and particulars of the instrument modifying the charge. Set out in detail the nature of modification. In other words, state by the said instruments, how the charge is already has been registration and modified. The instrument might be a simple letter ceding pari passu charge on the properties already charged by an existing charge holder to and in favour of another new entrant.

The procedure for modifying the charges created or modified for securing debentures and fee as stated there is payable.

Provisions are same for payment of additional fee too. If the particulars of charges are not registered in e-Form CHG-9 within 30 days provided they are filed within 300 days.

Provisions are same for making application to the central government for obtaining condonation of delay in filing the e-Form CHG-9 beyond 300 days.

When a modification of registration, a charge is registered by the registrar. He can furnish a certificate of registration of such charge in Form No.CHG-2.

Consequences of failure to register the particulars of modification of charges. The nature of offences and punishments thereto are the same as those arising from default in charges of registration.

The company should keep at its registration in Chennai (ROC). A register of charges in Form No.CHG-7. Enter therein particulars of not only the charges created on any of the assets, property or undertaking of the company.

The particulars of any property acquired subject to a charge. But, also the particulars of any modification of a charge until the satisfaction of the charge. The procedure for entering particulars in the Register of Charges. The details which have to be mentioned in Chennai (ROC) Registrar of Companies.