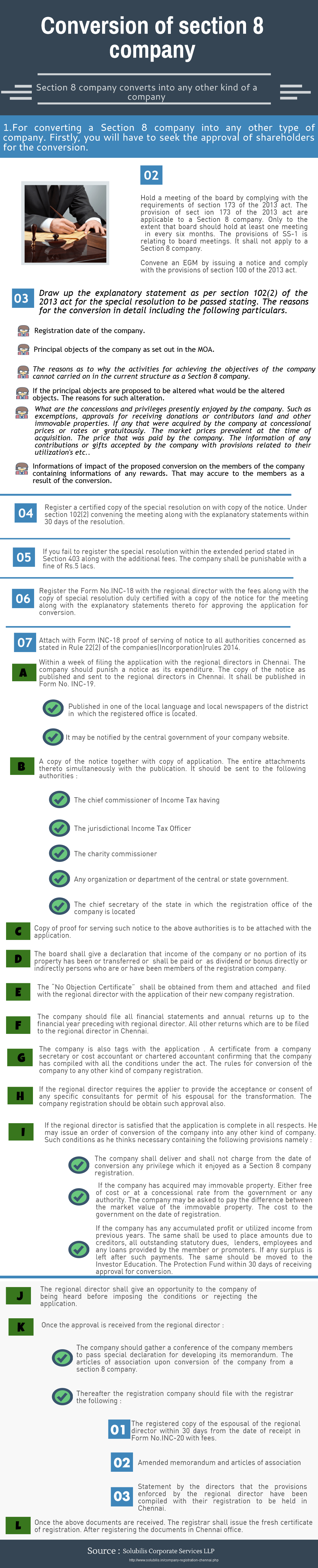

Section 8 company converts into any other kind of a company

1.For converting a Section 8 company into any other type of company. Firstly, you will have to seek the approval of shareholders for the conversion.

Conversion of section 8 company

2.Hold a meeting of the board by complying with the requirements of section 173 of the 2013 act. The provision of sect ion 173 of the 2013 act are applicable to a Section 8 company. Only to the extent that board should hold at least one meeting in every six months. The provisions of SS-1 is relating to board meetings. It shall not apply to a Section 8 company. Convene an EGM by issuing a notice and comply with the provisions of section 100 of the 2013 act.

3.Draw up the explanatory statement as per section 102(2) of the 2013 act for the special resolution to be passed stating. The reasons for the conversion in detail including the following particulars.

(i) Registration date of the company.

(ii) Principal objects of the company as set out in the MOA.

(iii) The reasons as to why the activities for achieving the objectives of the company cannot carried on in the current structure as a Section 8 company.

(iv) If the principal objects are proposed to be altered what would be the altered objects. The reasons for such alteration.

(v) What are the concessions and privileges presently enjoyed by the company. Such as excemptions, approvals for receiving donations or contributors land and other immovable properties. If any that were acquired by the company at concessional prices or rates or gratuitously. The market prices prevalent at the time of acquisition. The price that was paid by the company. The information of any contributions or gifts accepted by the company with provisions related to their utilization’s etc..

(vi) Informations of impact of the proposed conversion on the members of the company containing informations of any rewards. That may accure to the members as a result of the conversion.

- Register a certified copy of the special resolution on with copy of the notice. Under section 102(2) convening the meeting along with the explanatory statements within 30 days of the resolution.

- If you fail to register the special resolution within the extended period stated in Section 403 along with the additional fees. The company shall be punishable with a fine of Rs.5 lacs.

- Register the Form No.INC-18 with the regional director with the fees along with the copy of special resolution duly certified with a copy of the notice for the meeting along with the explanatory statements thereto for approving the application for conversion.

- Attach with Form INC-18 proof of serving of notice to all authorities concerned as stated in Rule 22(2) of the companies(Incorporation)rules 2014.

(a) Within a week of filing the application with the regional directors in Chennai. The company should punish a notice as its expenditure. The copy of the notice as published and sent to the regional directors in Chennai. It shall be published in Form No. INC-19.

(i) Published in one of the local language and local newspapers of the district in which the registered office is located.

(ii) It may be notified by the central government of your company website.

(b) A copy of the notice together with copy of application. The entire attachments thereto simultaneously with the publication. It should be sent to the following authorities :

- The chief commissioner of Income Tax having

- The jurisdictional Income Tax Officer

- The charity commissioner

- Any organization or department of the central or state government.

- The chief secretary of the state in which the registration office of the company is located

(iii) Copy of proof for serving such notice to the above authorities is to be attached with the application.

(iv) The board shall give a declaration that income of the company or no portion of its property has been or transferred or shall be paid or as dividend or bonus directly or indirectly persons who are or have been members of the registration company.

(v) The “No Objection Certificate” shall be obtained from them and attached and filed with the regional director with the application of their new company registration.

(vi) The company should file all financial statements and annual returns up to the financial year preceding with regional director. All other returns which are to be filed to the regional director in Chennai.

(vii) The company is also tags with the application . A certificate from a company secretary or cost accountant or chartered accountant confirming that the company has compiled with all the conditions under the act. The rules for conversion of the company to any other kind of company registration.

(viii) If the regional director requires the applier to provide the acceptance or consent of any specific consultants for permit of his espousal for the transformation. The company registration should be obtain such approval also.

(ix) If the regional director is satisfied that the application is complete in all respects. He may issue an order of conversion of the company into any other kind of company. Such conditions as he thinks necessary containing the following provisions namely :

- The company shall deliver and shall not charge from the date of conversion any privilege which it enjoyed as a Section 8 company registration.

- If the company has acquired may immovable property. Either free of cost or at a concessional rate from the government or any authority. The company may be asked to pay the difference between the market value of the immovable property. The cost to the government on the date of registration.

- If the company has any accumulated profit or utilized income from previous years. The same shall be used to place amounts due to creditors, all outstanding statutory dues, lenders, employees and any loans provided by the member or promoters. If any surplus is left after such payments. The same should be moved to the Investor Education. The Protection Fund within 30 days of receiving approval for conversion.

(x) The regional director shall give an opportunity to the company of being heard before imposing the conditions or rejecting the application.

(xi) Once the approval is received from the regional director :

- The company should gather a conference of the company members to pass special declaration for developing its memorandum. The articles of association upon conversion of the company from a section 8 company.

- Thereafter the registration company should file with the registrar the following :

- The registered copy of the espousal of the regional director within 30 days from the date of receipt in Form No.INC-20 with fees.

- Amended memorandum and articles of association

- Statement by the directors that the provisions enforced by the regional director have been compiled with their registration to be held in Chennai.

(xii)Once the above documents are received. The registrar shall issue the fresh certificate of registration. After registering the documents in Chennai office.